JINFU NEW MATERIAL 2023 Interim Report: Revenue Increases by 31.3%, Net Profit Loss Widens

" JINFU NEW MATERIAL(stock code: 300128) is a company operating in the field of computer, communication, and other electronic equipment manufacturing. Its main products include FCT functional fixtures, MDA press fixtures, ICT vacuum fixtures, and automated testing systems, which are used to test the performance of integrated circuit boards, chip circuits, and various electronic components. In addition, JINFU NEW MATERIAL also produces liquid crystal display modules, backlight modules, and liquid crystal modules in the field of optical optoelectronic component manufacturing, as well as optoelectronic display films and precision functional devices. The company also provides adhesive products, insulation products, and built-in metal structural parts for mobile phones and tablets. Furthermore, Xiamen Lifeng, a wholly-owned subsidiary of JINFU NEW MATERIAL, produces aerogel insulation products, mainly used in the field of new energy vehicle power batteries. The company also provides power equipment maintenance and installation services, offering technical service solutions and environmental engineering construction for industries such as power equipment, communication equipment, and precision electronic equipment.

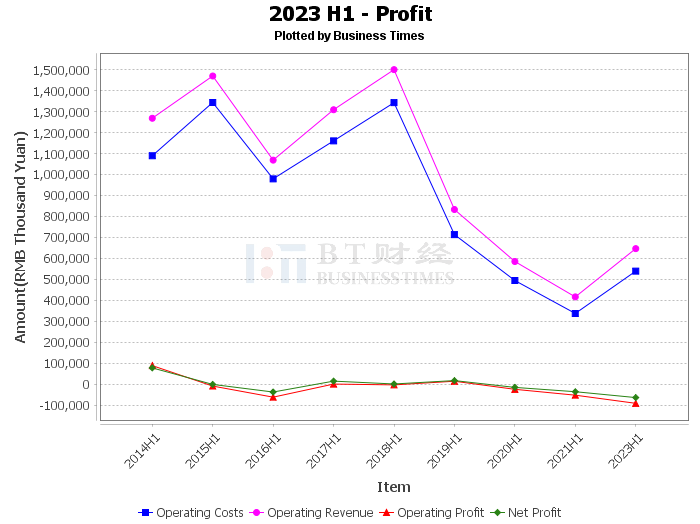

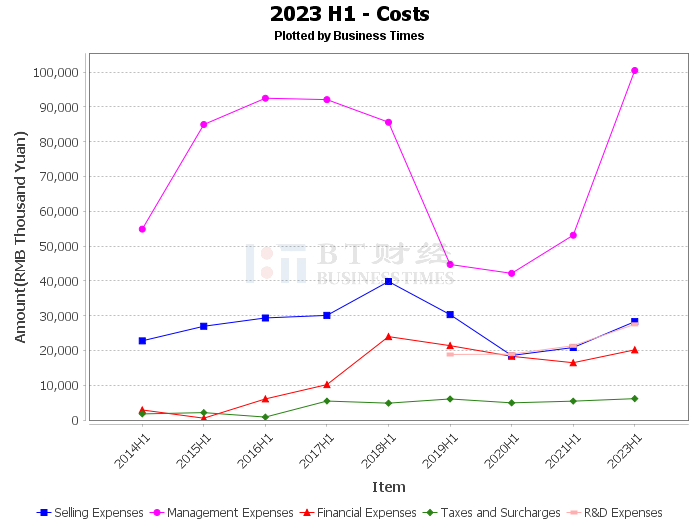

According to JINFU NEW MATERIAL's 2023 interim report, the company's operating income was 647 million yuan, an increase of 31.3% year-on-year, mainly due to an increase in customer orders during the period. Operating costs were 539 million yuan, an increase of 32.75% year-on-year, mainly due to an increase in operating income and corresponding increase in operating costs. Administrative expenses increased by 44.8% year-on-year, mainly due to the depreciation and amortization of the increased value of the merged assets of Shenjie Environmental Protection and the amortization of equity incentive costs for core personnel of Maizhi Technology. Financial expenses increased by 64.82% year-on-year, mainly due to an increase in interest expenses compared to the same period last year.

Credit impairment losses decreased by 1627.13% year-on-year, mainly due to an increase in bad debt provisions during the period. Asset impairment losses increased by 67.77% year-on-year, mainly due to a decrease in inventory price loss provisions during the period. Other income increased by 76.15% year-on-year, mainly due to an increase in government subsidies received during the period. Non-operating income decreased by 49.33% year-on-year, mainly due to an increase in default compensation from Suzhou Jiutai in the previous period. Income tax expenses increased by 60.97% year-on-year, mainly due to a decrease in deferred income tax assets corresponding to deductible losses during the period.

The net cash flow from operating activities was -138 million yuan, a decrease of 79.99% year-on-year, mainly due to an increase in cash for tax payments and receivables during the period. The net cash flow from investing activities was -60.6 million yuan, an increase of 84.79% year-on-year, mainly due to the payment for the acquisition of Shenjie Environmental Protection shares in the previous period. The net cash flow from financing activities was 130 million yuan, a decrease of 71.38% year-on-year, mainly due to an increase in long-term loans for the acquisition of Shenjie Environmental Protection shares in the previous period.

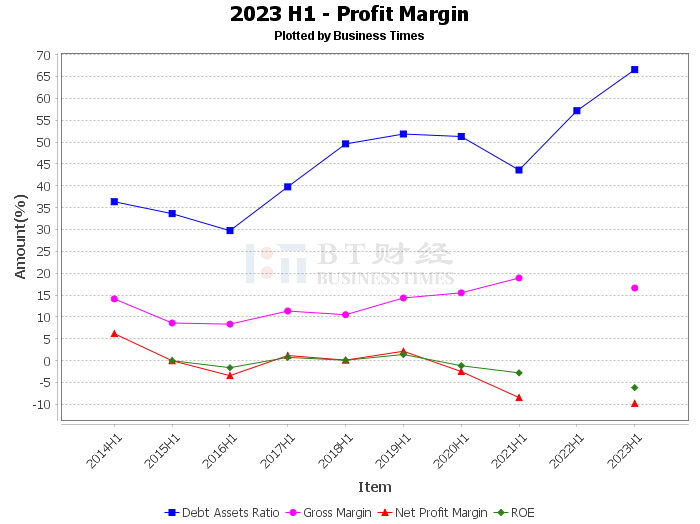

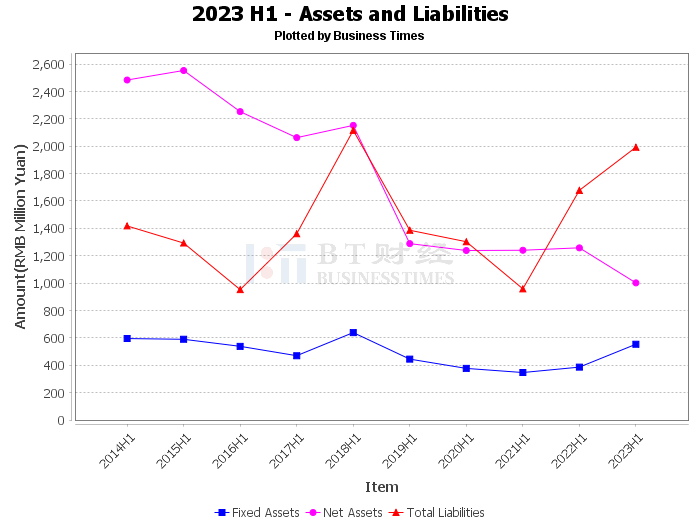

Total assets at the end of the period were 2.995 billion yuan, an increase of 146 million yuan from the beginning of the period. Total liabilities were 1.993 billion yuan, an increase of 185 million yuan from the beginning of the period. The balance of goodwill at the end of the period was 268 million yuan, the same as at the beginning of the period. The balance of net assets at the end of the period was 1.002 billion yuan, a decrease of 40 million yuan from the beginning of the period. The asset-liability ratio at the end of the period was 66.55%, an increase of 3.11 percentage points from the beginning of the period.

The gross profit margin for this reporting period was 16.6%, a decrease of 0.91 percentage points from the same period last year. The net profit margin was -9.77%, a decrease of 10.17 percentage points from the same period last year. The return on equity (ROE) was -6.18%. Operating profit was -90.5 million yuan, an increase in losses of 3.5 million yuan from the same period last year. Net profit was -63.2 million yuan, an increase in losses of 83.1 million yuan from the same period last year.

In summary, although JINFU NEW MATERIAL's operating income increased in the first half of 2023, the net profit was in deficit due to increased costs and expenses, and the net cash flow from operating activities also significantly decreased. The company needs to further optimize its cost structure, improve profitability, and strengthen cash flow management to ensure the company's healthy development. Investors need to fully consider the company's operating conditions and industry development trends when investing.

This article only represents the judgment of the analyst or the judgment made by the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."