Zhendong PHARMACY 2023 Interim Report: Increase in Operating Revenue, Significant Change in Net Cash Flow

"Zhendong PHARMACY (stock code: 300158) is a company of significant standing in the pharmaceutical industry, with its main business encompassing the research and development, production, and sales of generic and innovative drugs, as well as the cultivation and processing of the entire industry chain of traditional Chinese medicine materials. Zhendong PHARMACY has a certain influence in the pharmaceutical industry, being rated as one of the top 100 pharmaceutical manufacturers and ranking among the top in the TOP 100 list of Chinese chemical pharmaceutical companies.

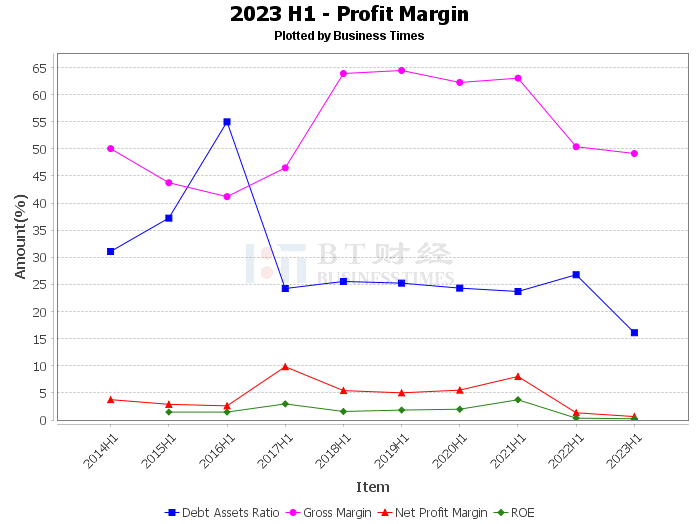

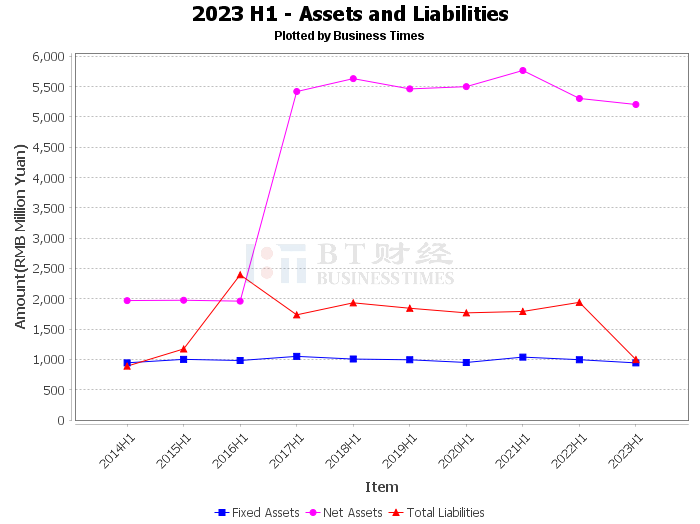

Zhendong PHARMACY's 2023 interim report shows that the company's total assets at the end of the period were 6.201 billion yuan, slightly down from the beginning of the period's 6.551 billion yuan. The total liabilities at the end of the period were 997 million yuan, down from the beginning of the period's 1.328 billion yuan. The goodwill at the end of the period was 40.2 million yuan, consistent with the beginning of the period. The net assets at the end of the period were 5.204 billion yuan, slightly lower than the beginning of the period's 5.223 billion yuan. The asset-liability ratio at the end of the period was 16.08%, down from the beginning of the period's 20.27%.

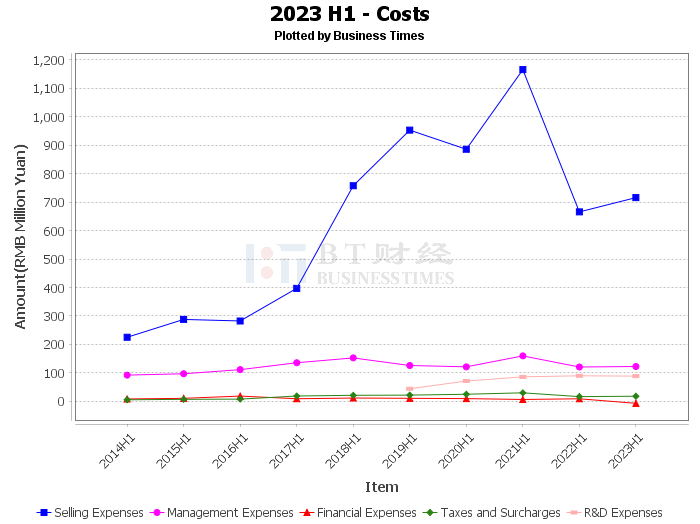

In terms of profitability, Zhendong PHARMACY's gross profit margin was 49.15%, slightly down from the same period last year's 50.4%. The net profit margin was 0.63%, down from the same period last year's 1.33%. The return on equity (ROE) was 0.23%. Operating income was 1.933 billion yuan, up from the same period last year's 1.726 billion yuan. Operating profit was 28.6 million yuan, down from the same period last year's 57.9 million yuan. Operating costs were 983 million yuan, up from the same period last year's 856 million yuan. Net profit was 12.2 million yuan, down from the same period last year's 22.9 million yuan.

In terms of cash flow, the net cash flow generated by operating activities was -108 million yuan, significantly down from the same period last year's -20.7 million yuan, mainly due to an increase in cash paid for the purchase of goods and acceptance of labor services. The net cash flow generated by investing activities was 428 million yuan, significantly down from the same period last year's 2.557 billion yuan, mainly due to a decrease in cash received from investment recovery. The net cash flow generated by financing activities was -157 million yuan, significantly up from the same period last year's -2.415 billion yuan, mainly due to a decrease in cash paid for dividend distribution, profit distribution, and interest payment. The balance of cash and cash equivalents at the end of the period was 847 million yuan, down from the same period last year's 1.305 billion yuan.

Overall, Zhendong PHARMACY's operating income increased in the first half of 2023, but net profit, operating profit, and net cash flow all decreased. In future operations, the company needs to further improve its profitability and cash flow management to enhance its operational efficiency and profitability. For investors, it is necessary to closely monitor the company's operating conditions and industry trends to make rational investment decisions.

This article only represents the judgment of the analyst himself or the judgment made by the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."