EWPT 2023 Interim Report: Significant Growth in New Energy Business, Slight Decrease in Debt-to-Asset Ratio, Future Development Worth Looking Forward To

"Shenzhen Everwin Precision Technology Co., Ltd. (stock code: 300115) specializes in the development, production, and sales of electronic connectors, precision components of intelligent electronic products, new energy connectors, structural parts and modules, precision structural parts and modules of consumer electronics, robots, and industrial internet products. The company, with product design, precision mold design, and intelligent manufacturing as its core competencies, keeps pace with the development of the electronic information industry and new energy, continuously develops high-precision, high-performance, high-value-added new products, and gradually moves towards intelligent manufacturing.

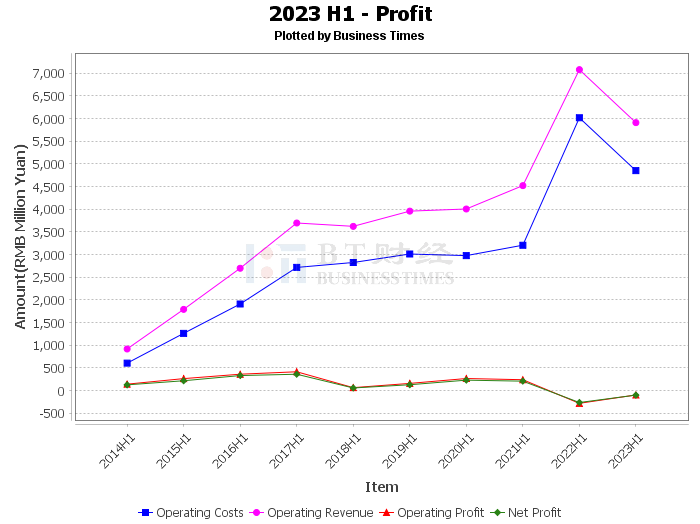

According to EWPT's 2023 interim report, during the reporting period, the company's operating income was 5.91 billion yuan, a decrease of 16.51% compared to the same period last year. Although the consumer electronics business was affected by the decline in shipments of smart terminals, the new energy business maintained rapid growth, accounting for 23.42% of the company's total revenue. This indicates that the company's layout in the new energy field has begun to yield results, and it is expected to further increase its market share in the new energy field in the future.

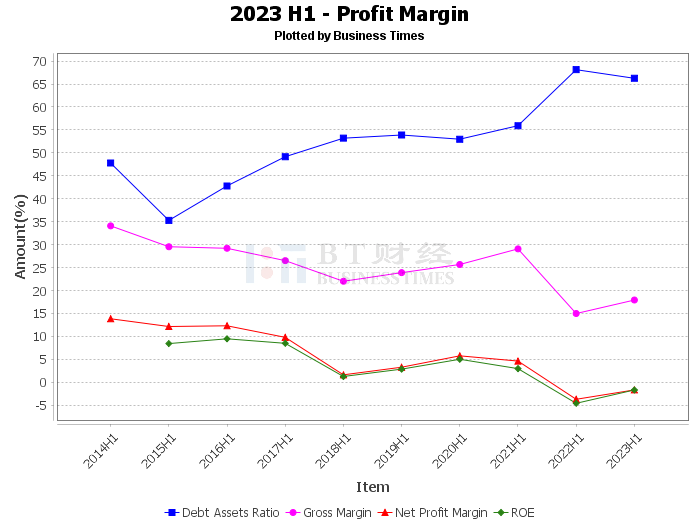

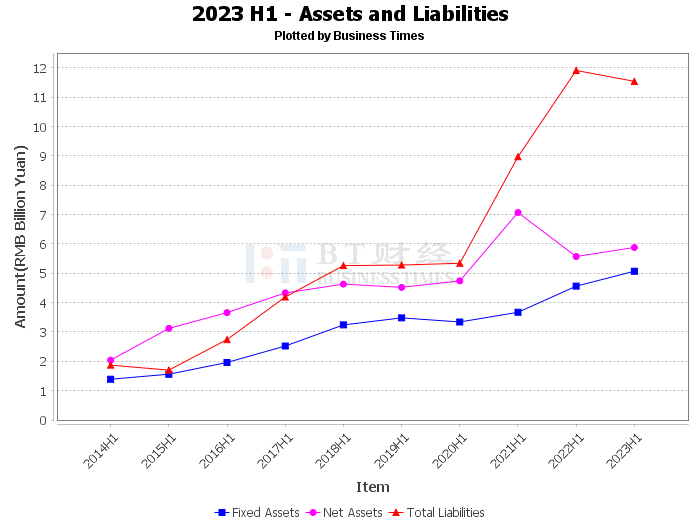

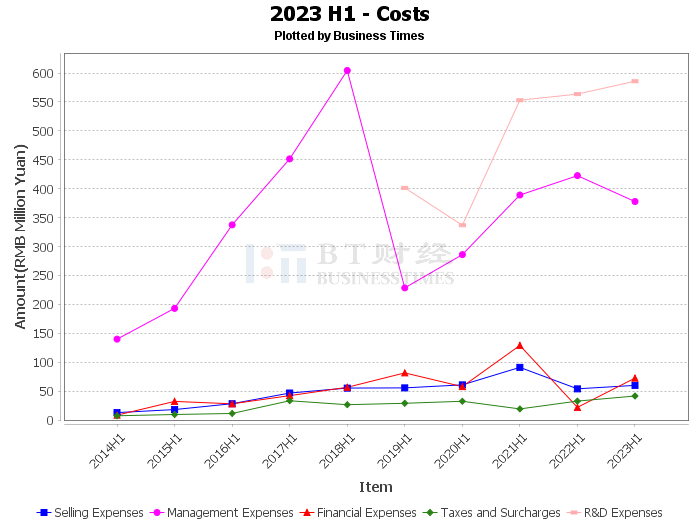

In terms of finance, the company's total assets at the end of the period were 17.4 billion yuan, total liabilities at the end of the period were 11.5 billion yuan, and the asset-liability ratio at the end of the period was 66.25%, a slight decrease from 66.38% at the beginning of the period, showing the company's robust financial structure. Meanwhile, the company's gross profit margin for this reporting period was 17.92%, an increase from 14.98% in the same period last year, indicating an improvement in the company's profitability. However, the net profit margin for this reporting period was -1.67%, an improvement from -3.71% in the same period last year, but still in a loss state. This is mainly due to the company's large investment in expanding market share and improving technical research and development capabilities.

In terms of cash flow, the net cash flow generated by operating activities in this reporting period was 474 million yuan, a significant improvement from -110 million yuan in the same period last year, indicating an increase in the company's cash inflow from operating activities. The net cash flow generated by investment activities in this reporting period was -715 million yuan, a decrease from -811 million yuan in the same period last year, indicating a increase in the company's cash outflow from investment activities. The net cash flow generated by financing activities in this reporting period was 491 million yuan, a decrease from 1.261 billion yuan in the same period last year, indicating a decrease in the company's cash inflow from financing activities.

Overall, EWPT's 2023 interim report shows rapid growth in its new energy business, a robust financial structure, and improved cash flow. Although the company is still in a loss state, its layout in the new energy field and the improvement of its technical research and development capabilities make it possible for the company to achieve profitability in the future. Therefore, investors considering investing in EWPT should fully consider the company's business development prospects and financial situation.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."