Joyson Electronics Q3 2023 Report: Steady Performance Growth, Opportunities in the Intelligent Electrification Market Emerge

"Joyson Electronics (stock code: 600699) is a globally competitive enterprise in the automotive industry. The company has achieved steady growth driven by the alleviation of global automotive supply chain shortages and the recovery of demand in major consumer markets. According to the third quarter report of 2023, the company has achieved fruitful new orders under the opportunities of intelligent electrification in the global automotive industry and the rise of Chinese independent brands.

In terms of assets and liabilities, Joyson Electronics' total assets reached 56.355 billion yuan, an increase from 54.112 billion yuan at the end of the previous year. Total liabilities were 37.379 billion yuan, slightly increased from 36.408 billion yuan at the end of the previous year. The company's net assets were 18.975 billion yuan, an increase from 17.704 billion yuan at the end of the previous year. The asset-liability ratio was 66.33%, down from 67.28% at the end of the previous year. These figures show that the company's assets are stable, liabilities are well controlled, net assets are growing, and the asset-liability ratio is moderate.

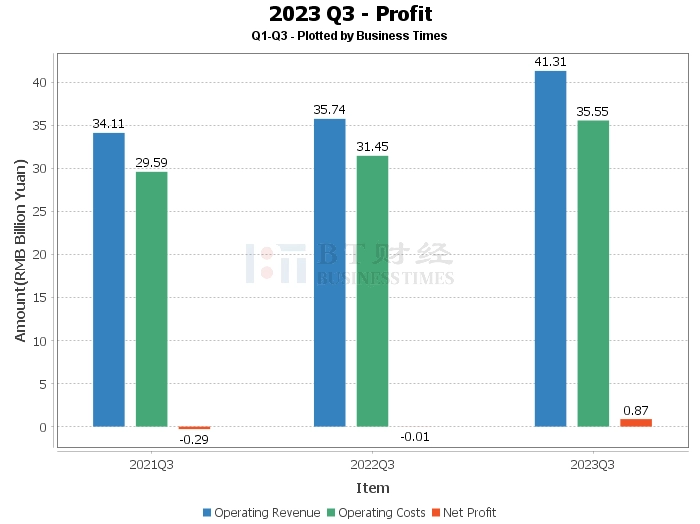

In terms of profit, Joyson Electronics' operating income for the first half of 2023 was about 27 billion yuan, an increase of about 18% year-on-year. Among them, the operating income of the automotive electronics business and automotive safety business increased by about 24% and 15% respectively. The company turned losses into profits, with a net profit attributable to the parent of about 476 million yuan, an increase of about 385% year-on-year. These figures show that the company's profitability has significantly improved.

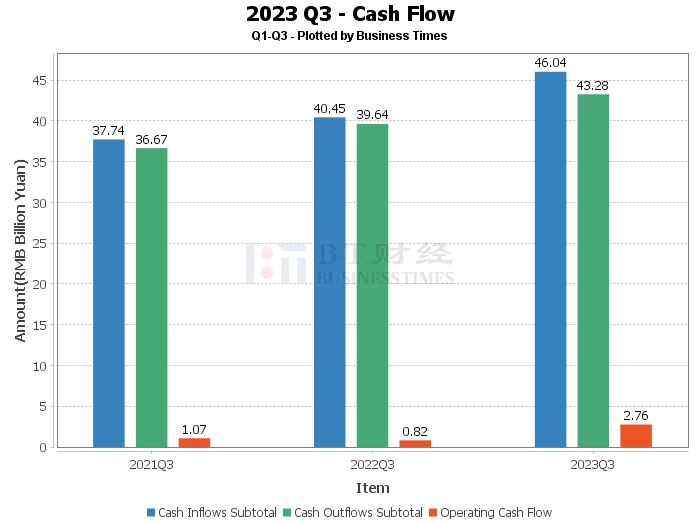

In terms of cash flow, the net cash flow from operating activities was 2.756 billion yuan, a significant increase from 818 million yuan in the same period of the previous year. The subtotal of cash inflow from operating activities was 46.041 billion yuan, and the subtotal of cash outflow from operating activities was 43.285 billion yuan. These figures show that the company's cash flow situation is good, with cash inflow exceeding cash outflow, and there is sufficient cash flow to support the company's operations.

Overall, Joyson Electronics has shown a good development momentum in the global automotive industry, achieving steady financial performance by seizing market opportunities and improving profitability. The company's assets are stable, liabilities are well controlled, profitability has significantly improved, and the cash flow situation is good.

For investors, Joyson Electronics has good investment value. The company has a competitive advantage in the global automotive industry, has seized the opportunities of intelligent electrification in the global automotive industry and the rise of Chinese independent brands, and has achieved fruitful new orders. The company's financial performance is steadily growing, profitability has significantly improved, and the cash flow situation is good. Therefore, investors can consider including Joyson Electronics in their investment portfolio.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."