Haixin Energy-Tech 2023 Interim Report: Steady Progress in Bioenergy Core Business, Operating Revenue and Net Profit Decline Due to Market Impact

"Haixin Energy-Tech (stock code: 300072) is a company specializing in the field of bioenergy and environmental protection materials. In its 2023 interim report, the company focused on its core business of biodiesel through strengthening production management and improving organizational efficiency, and steadily promoted catalytic purification, new coal chemical industry, and specialty chemical businesses. The company also completed the divestiture of non-core business assets, improving asset quality.

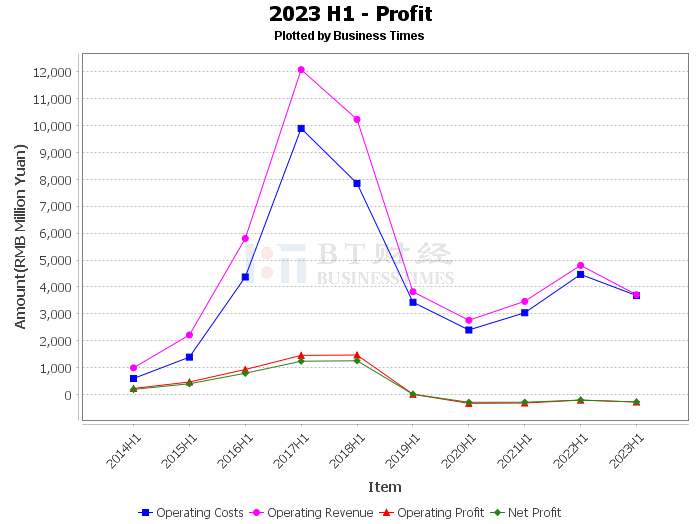

According to the company's 2023 interim report, during the reporting period, the company achieved operating income of RMB 3,711,851,800, a decrease of 22.76% year-on-year. This decrease was mainly due to the impact of low prices of hydrocarbon-based biodiesel and the downward trend of coke prices on the company's performance. Meanwhile, the net profit attributable to shareholders of the listed company was -RMB 166,978,500, indicating a loss during the reporting period.

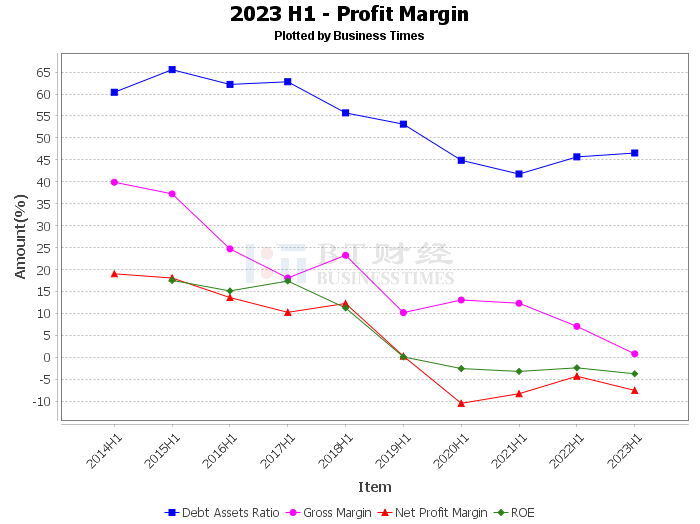

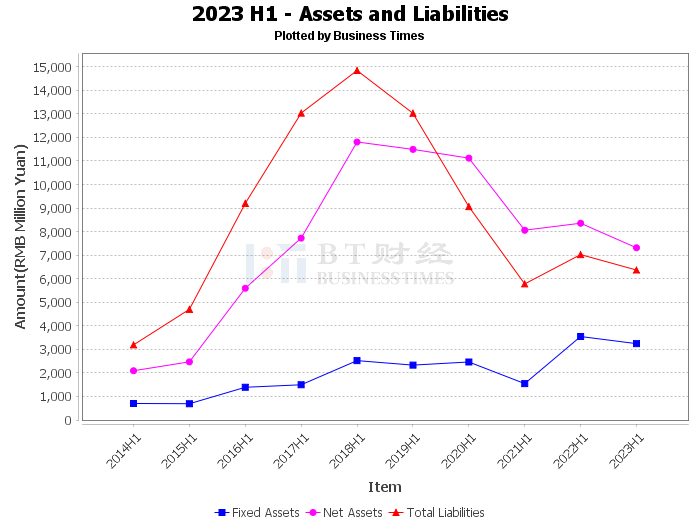

In terms of financial data, the company's total assets were RMB 13.7 billion, a decrease from RMB 15.3 billion at the beginning of the period. Total liabilities were RMB 6.368 billion, a decrease of RMB 1.354 billion from RMB 7.722 billion at the beginning of the period. This may be due to the company's divestiture of non-core business assets during the reporting period, thereby reducing liabilities. The asset-liability ratio at the end of the period was 46.55%, a decrease from 50.55% at the beginning of the period, indicating an improvement in the company's financial structure.

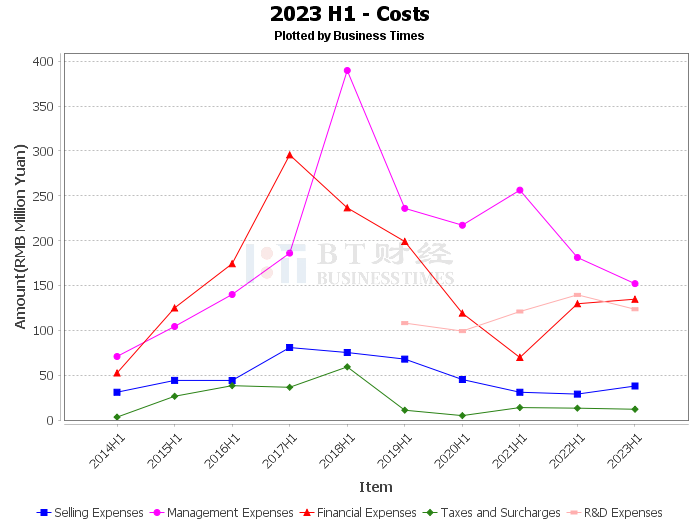

In terms of operating data, the company's operating income was RMB 3.712 billion, a decrease of RMB 1.094 billion from RMB 4.806 billion in the same period of the previous year. Operating profit was -RMB 278 million, a decrease of RMB 70 million from -RMB 208 million in the same period of the previous year. This may be due to the low prices of hydrocarbon-based biodiesel and the downward trend of coke prices.

In terms of cash flow, the net cash flow generated by operating activities was -RMB 46.5 million, an improvement from -RMB 303 million in the same period of the previous year. The net cash flow generated by investment activities was RMB 874 million, a significant increase from -RMB 169 million in the same period of the previous year. This may be due to the company receiving equity payments from the transfer of wholly-owned subsidiaries Sanju Green Energy, Nanjing Sanju, controlling subsidiary Sanju Green Source, and associated company Sanju Yujin during the reporting period. The net cash flow generated by financing activities was -RMB 763 million, a decrease from RMB 650 million in the same period of the previous year, which may be due to the company's increased repayment of financial aid from Haiguo Investment Group.

Overall, Haixin Energy-Tech faced some market challenges in the first half of 2023, resulting in a decline in operating income and net profit. However, the company successfully improved its financial structure and cash flow situation by strengthening production management and improving organizational efficiency, as well as completing the divestiture of non-core business assets. In the future, the company needs to continue to pay attention to market dynamics, adjust business strategies, and respond to possible market risks. For investors, although the company currently faces some challenges, its professionalism and robust business strategy in the field of bioenergy and environmental protection materials are still worth paying attention to.

This article only represents the judgment of the analyst himself or the analyst based on AI analysis, and cannot be used as any investment indicator, nor does it constitute any investment advice. The original intention of this article is to help investors analyze and judge capital market data in the most intuitive, fastest way, and from the most professional perspective."